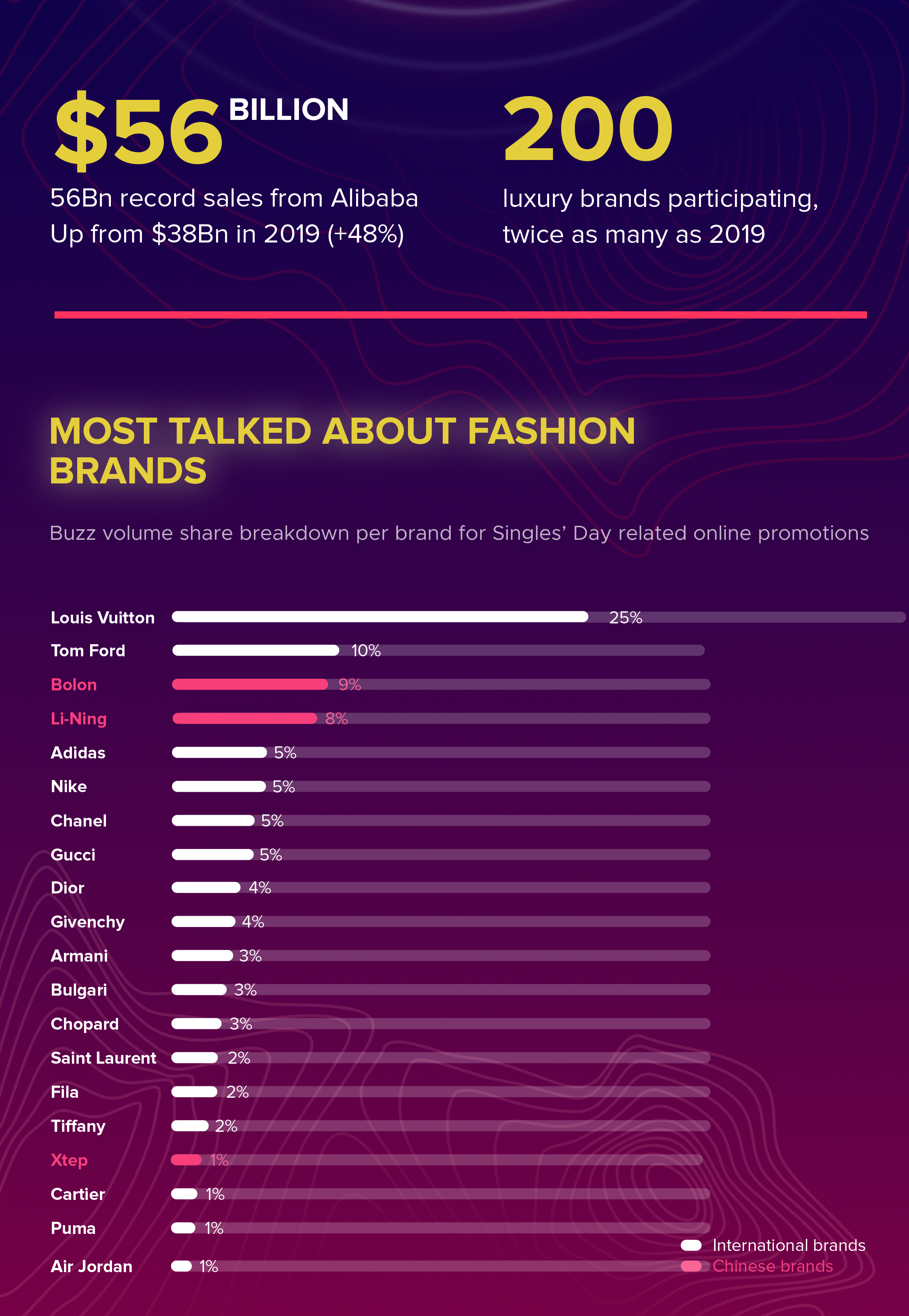

What fashion and luxury brands generate the most attention among Chinese consumers during the Singles’ Day shopping holidays? Using a buzz analysis, we were able to find out. Louis Vuitton attracts by far the most attention, but the Top 5 also includes some Chinese brands that are not well-known in the West.

China is a highly digitized society with about 900 million netizens who spend an around six hours a day on the Internet on average – mostly on domestic Chinese websites and platforms. Their online behavior in relation to brands can reveal much about the popularity of these brands in China. For instance, the attention generated by a brand relative to other brands can be determined accurately using a certain digital metric: the so-called “buzz.”

In this case, buzz consists of brand mentions in discussions on social media platforms, comment and review areas on various websites and forums. By comparing the shares that a brand holds in the overall buzz in relation to a topic such as Singles’ Day online, it is possible to calculate which brand can generate the most attention. As a rule, successful marketing campaigns or business strategies in particular catapult a brand to the top of the buzz ranking.

For the social listening analysis on the occasion of Singles’ Day, 20 fashion brands were considered which generate the most buzz on average among Chinese Internet users over the entire year. The analysis covered the first eleven days of November, including Singles’ Day on November 11, which reflects the main period for discounts and other Singles’ Day promotions. The most relevant Chinese Internet platforms were included in the analysis.

In addition, it was also investigated which Chinese e-commerce platforms, the main drivers of the shopping holidays, have the highest shares in the buzz volume. This allows us to deduce which Chinese platforms are currently the most relevant for the fashion and luxury category.

Two Chinese brands in the top 5, Louis Vuitton on top

With a 25 percent share of the total buzz volume, Louis Vuitton is the undisputed leader in the ranking of brands that were able to generate the most attention during the campaign period. Two important reasons for this success: the brand’s collaboration with the popular Chinese actor Zhu Yilong as brand ambassador and, to a lesser extent, the appointment of Virgil Abloh, for years one of the world’s most important fashion influencers and founder of the brand Off-White, as art director for the men’s collection.”In China, influencers have an even greater weight in influencing the perception of a brand than in the West,” says Lars-Alexander Mayer, Partner at TD Reply. “Across all industries, we see impressive examples of how working with Chinese influencers is helping Western brands to gain more attention in China. But it is very important to work with the right influencer. Specialized social listening tools can help here.“

Louis Vuitton is followed by Tom Ford, which opened its largest store in the world in Guangzhou, China, this October. This move was accompanied by attractive discounts during the Singles’ Day promotions and is largely responsible for the very good performance of the brand. With eyewear specialist Bolon in third place and sporting goods manufacturer Li-Ning in fourth place, two Chinese brands are also in the top five. German sports fashion giant Adidas is placed fifth, and was able to generate slightly more attention than Nike, its main competitor.

Emerging new platforms

The Alibaba Group with its leading Chinese e-commerce platforms Tmall.com and Taobao is the creator of Singles’ Day as an online shopping holiday. These two platforms together account for 65 percent of total buzz volume. With a share of 52 percent, Tmall.com is by far the most relevant platform for fashion and luxury brands, followed by JD.com with a share of 26 percent.

Suning, an online and offline retailer formerly specializing in consumer electronics and a newcomer in the fashion and luxury segment, was also able to achieve a solid result of 7 percent. It was only in August this year when the company announced that it would also start selling luxury items online.

“China’s enormous platform landscape is growing continuously and we will certainly see some changes in the coming years,” says Lars-Alexander Mayer. “For Western brands, it is also important here to recognize these changes early on by tracking Chinese consumer behavior on the Internet and to exploit them to get ahead of the competition.”

BACK TO ALL ARTICLES