TD Reply has partnered with adidas to establish and manage a comprehensive global brand tracking initiative. The brand share of search program capitalizes on organic search data, integrating ‘Share of Search’ as a pivotal Key Performance Indicator (KPI) for assessing Brand Strength. By tracking organic search data, adidas gains a more precise, data-driven understanding of their brand’s position in a volatile and ever-evolving market. The comprehensive end to end tracking approach of the program facilitates informed, strategic, and operational decision-making and improved adidas’s ability to effectively adapt and thrive in a dynamic business environment.

CUSTOMER GOAL

The main objective of the project was to define a more flexible, granular, and near-time Brand KPI System that leverages digital consumer data to track brand strength, improve measurability and meets the following objectives::

Strong link to business impact :

(Strong correlations of KPI with commercial data and early indication for changes in sales and market share)

Adaptive to changes in the marketplace :

(End to End tracking from an overall Brand level, down to categories, products and partnerships)

In-time Insights:

(high frequency of data gathering to enable attribution of single activities on brand interest)

Efficient to execute :

(Significant cost advantages over existing survey-based Brand Tracking Solution and higher flexibility to adjust scope with access to historical data)

Global Scalability:

(Global Coverage including Baidu, Good Capture of Competitors, Robust Data Volumes across countries)

CHALLENGE

1. Developing a Global End-to-End Tracking System: One of the most daunting challenges was the creation of a tracking system capable of accurately capturing market realities on a global scale. The system had to be:

Scalable Across Diverse Geographies and Languages:

Covering 29 countries and 19 languages, the system required immense scalability and adaptability to accommodate diverse market nuances and linguistic variations.

Comprehensive for Multiple Categories, Brands,

and Products:

With the inclusion of 8 categories, over 70 brands, and hundreds of products, the complexity of the system increased exponentially. It needed to be robust enough to handle vast amounts of data while remaining precise in its analysis and reporting.

2. Balancing Stability with Market Dynamics: Maintaining the stability and comparability of the tracking system, while adapting to ever-changing market dynamics, was a critical balancing act:

Integration of New Market Elements:

The system had to be flexible to integrate new brands, products, and partners without disrupting the existing data’s consistency and historical comparability.

Responding to Rapid Market Changes:

Adapting to market dynamics in real-time, without compromising the integrity and relevance of the KPI, was paramount in a swiftly evolving market landscape.

3. Senior Management Buy-In: Securing senior management buy-in for a new KPI based on digital

behavioral data was a significant hurdle:

Shift from Traditional Methods:

Convincing the leadership to move away from traditional survey-based data to a more digital-centric approach required a strategic approach.

Proof of Concept for Trust Building:

Extensive validation and testing in the initial Proof of Concept phase were critical in demonstrating the effectiveness and reliability of the new KPI, thereby building trust in the digital approach.

Internal Education and Communication: Post gaining senior management buy-in, the next challenge was to foster a collective understanding of the new KPI across the organization:

Engaging Diverse Departments and Business Units:

Conducting internal presentations and engaging directly with stakeholders across different business units, departments, and markets was key in educating and aligning them with the new system.

Facilitating Open Dialogue:

This approach was not just about information dissemination but also about encouraging open dialogue, addressing concerns, and nurturing a collaborative environment, essential for the smooth adoption and implementation of the new system.

SOLUTIONS

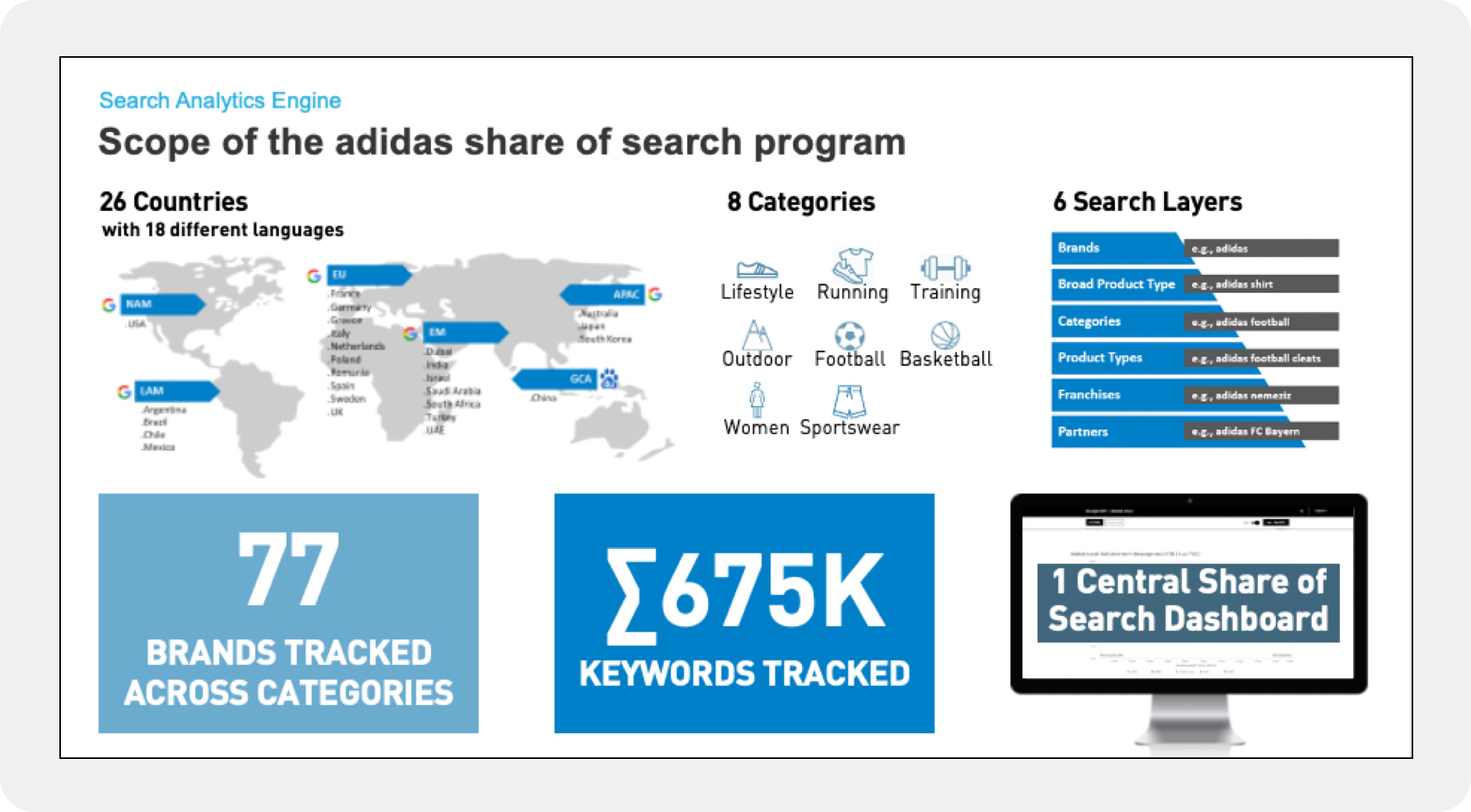

The project adopted a “Pilot, Test, Scale” approach to develop and implement a global brand tracking system using Share of Search as a central KPI. The Share of Search tracking scope covers 70+ competitors, 8 categories, and hundreds of products and partnerships in 18 languages and 29 international markets (including China through Baidu Search).We embarked on defining a collective vision spanning the entire brand communication landscape.

1. Share of Search Pilot and Extensive Validation:

The initial phase focused on evaluating the feasibility, validity, and relevance of using organic search data as a Brand Strength KPI.

• Building a Comprehensive Topic and Keywords Framework: A detailed framework was created encompassing over 600,000 keywords across brands, categories, partnerships, and products. This framework enabled granular insights across key layers such as Brand, Category, Product Type, and Franchises.

• Data Gathering, Analysis, and Sense Checking: The process involved collecting and analyzing data on both brand and category levels, including volume and share rankings, and search-sales correlations.

• Evaluation of Results Based on Success Criteria: The success of the pilot was measured against several criteria, including the ability to reflect market realities, tie to business performance, adapt to market changes, provide timely insights, execute efficiently, scale globally, and capture competitors effectively.

The outcome of this phase was the successful buy-in from senior management for a global rollout, underpinned by the pilot’s demonstration of the system’s efficacy and scalability.

2. Global Share of Search Program Implementation:

With the successful completion of the pilot, the project moved into its global implementation phase.

Market Rollouts: The program was expanded to additional markets, tailoring the approach to each region’s specific needs.

Tracking Scope Definition, Governance, and Management: This involved establishing the business logic, ensuring comparability, and managing stakeholder expectations across various brands, categories, and markets.

Infrastructure Development: The implementation included setting up a robust tracking infrastructure with data pipelines, dashboarding, and reporting formats.

Target and Ambition Setting: Based on historical growth patterns and projections, target ranges were defined using different growth functions.

Ongoing Reporting and Insight Generation: The system provided continuous reporting, offering crucial insights for strategic decision-making.

Informing Annual Strategy Process: Insights generated from the system played a key role in shaping the annual strategy process, aligning it with real-time market dynamics and brand performance metrics.

By adopting this structured approach, the project successfully implemented a comprehensive, scalable global brand tracking system. It not only provided valuable insights into brand performance but also equipped the organization with a dynamic tool to navigate and adapt to the ever-changing market landscape.

RESULTS

- Highly granular and comprehensive End to End tracking solution

- Significant cost advantages over existing survey-based Brand Tracking Solution

- Increased flexibility to continuously adjust tracking scope with access to historical data

- Leading indication for changes in sales and market share

- Better attribution of single activities on brand interest.